Private Equity: Coming to a Portfolio Near you

Over the last couple of years, private equity has become easier to access via product evolution, and recently through guidance from the Department of Labor (DOL). Secretary of Labor Eugene Scalia issued a letter explaining the DOL’s point-of-view regarding allowing private equity in retirement plans.

“. . . will help Americans saving for retirement gain access to alternative investments that often provide strong returns,(1)” U.S. Secretary of Labor Eugene Scalia said. “. . . helps level the playing field for ordinary investors and is another step by the Department to ensure that ordinary people investing for retirement have the opportunities they need for a secure retirement.”

Once the exclusive domain of family offices and institutions, private equity is now available to a broader segment of investors. As an industry, we need to ramp up the educational efforts to help Financial Advisors and individual investors make better informed decisions regarding the role and usage of private equity, private debt and private real estate.

Why is now a good time to invest in private equity?

The appeal of private equity has long been the opportunity for higher returns, and the diversification benefits relative to traditional investments. Family Offices and Institutions have historically allocated large percentages of their portfolios to private equity.

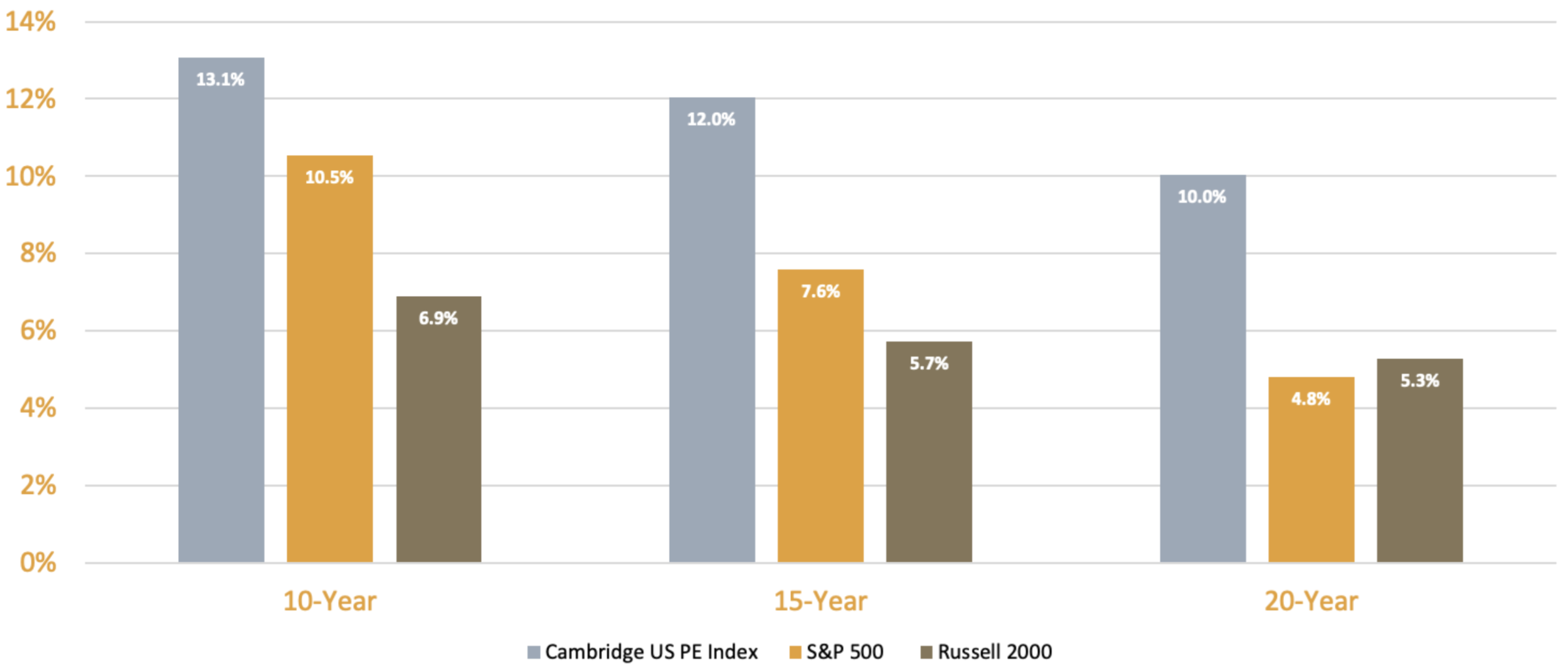

As the data below illustrates, private equity has outperformed traditional benchmarks like the S&P 500 and Russell 2000 over extended periods of time. Short-term results may vary, and private equity should be evaluated over a longer time horizon. According to Nick Veronis, Co-Founder and Managing Partner, iCapital Network, “Significant historical data show that private equity’s outperformance actually increases during distressed periods, a logical outcome given the long-term nature of the asset class(2).“ This is particularly relevant given our current market environment.

Private Equity Results Over Time

Source: Cambridge Associates, US Private Equity Index and Selected Benchmark Statistics, Q1 2020. For discussion purposes only. Future results are not guaranteed, and loss of principal may occur.

Of course, the question is whether the future will be like the past – especially given our current economic backdrop. If we consider J.P. Morgan’s forward-looking Capital Market Assumptions (CMAs), we can see that U.S Equity returns will likely be much lower over the next 10-15 years than their long-term historical average (7.2% vs. 10.2%); while private equity returns are projected to be around 10%. Investors are seeking alternative sources of returns in a lower return environment. Private equity looks attractive on both an absolute and relative basis.

SELECT LONG-TERM CAPITAL MARKET ASSUMPTIONS (10–15 YEARS)

Source: LTCMAs, J.P. Morgan Asset Management Multi-Asset Solutions, data as of April 20, 2020.

What is private equity?

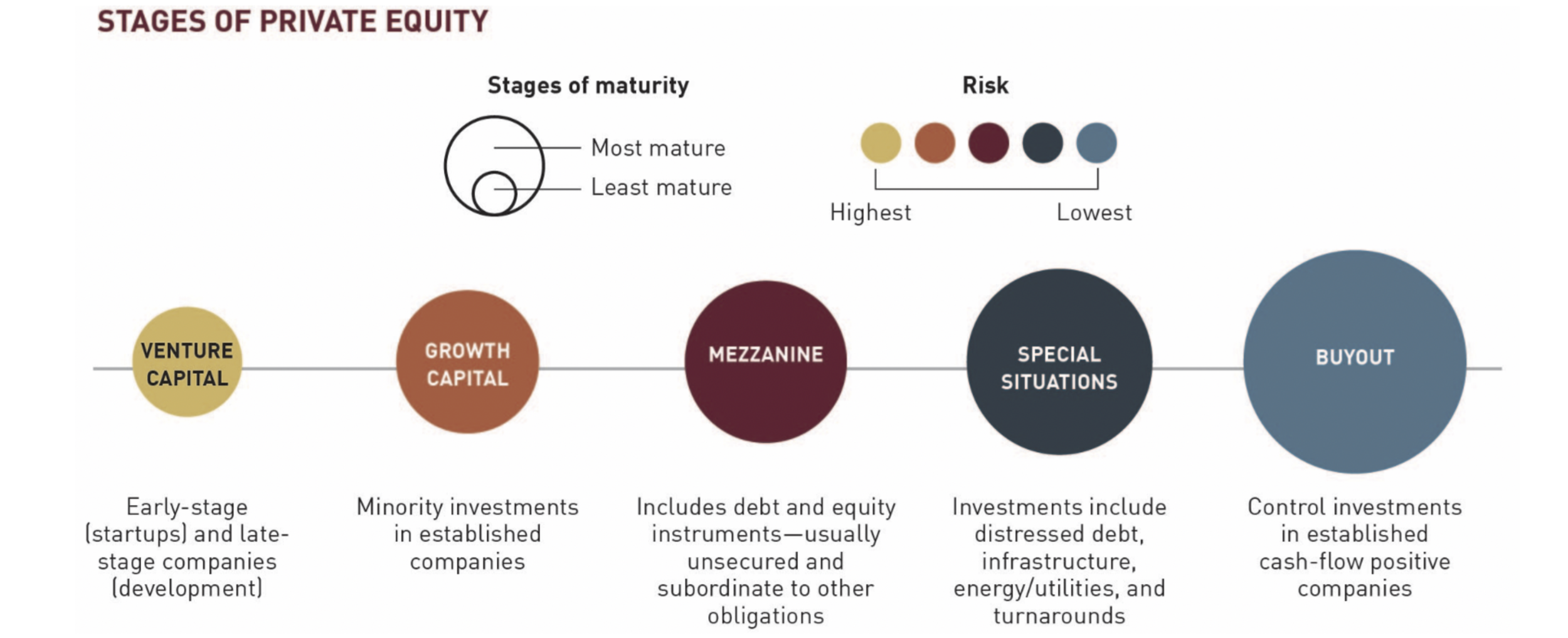

Private equity represents a broad grouping of non-publicly traded companies. The companies range from early stage venture capital to growth capital and buyouts. Part of the appeal has been the opportunity to invest in the next ‘unicorn’ – start-up companies with $1 billion - and reap the benefits once the company goes public via an Initial Public Offering (IPO). Everyone wants to invest in the next Google, Facebook or Snowflake - but these are venture capital investments, and miss the opportunities in growth equity and LBOs (see the stages of private equity below).

Source: Cambridge Associates, US Private Equity Index and Selected Benchmark Statistics, Q1 2020. For illustrated purposes only. Future results are not guaranteed, and loss of principal may occur.

Private companies are often early stage and need a longer runway to reach scale and profitability. Private equity firms provide capital and expertise to help them execute their strategies. Public companies must answer to shareholders and often manage from quarter-to-quarter.

How does Private Equity work?

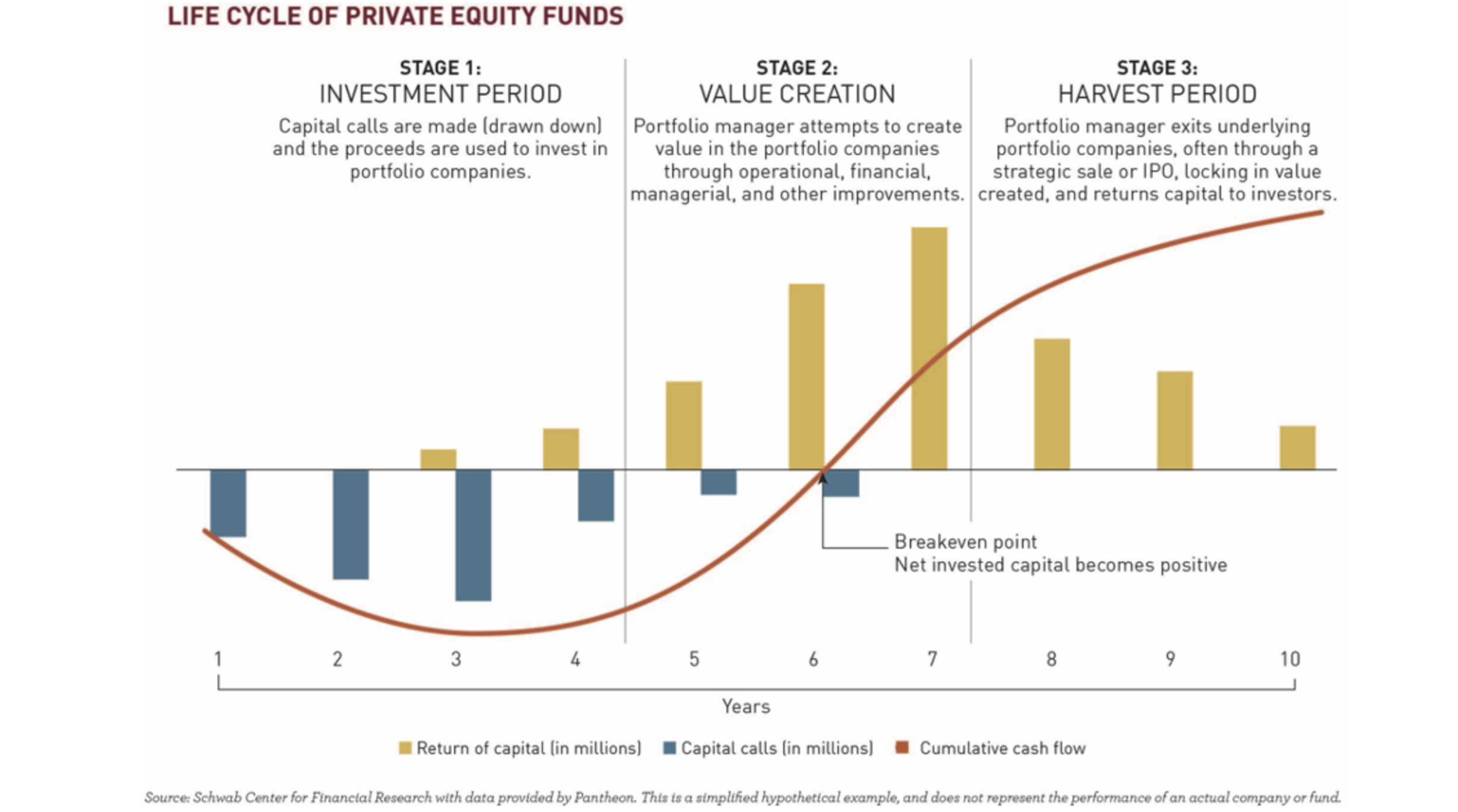

For those advisors that are new to private equity investing, it is important to understand the Life Cycle of Private Equity Funds and the impact of the J-Curve. During the early stages, capital is drawn down as the fund seeks investments, and the investment returns come later in the cycle as capital is deployed and value is created. Consequently, investors should consider private equity as a long-term investment (7-10 years).

Because of the impact of the J-Curve, investors may want to consider diversification across vintage years, or consider a diversified vehicle, to smooth out the effects of the draw-down. Product innovation has sought to address some of the structural limitations of typical PE Funds by making them more broadly assessable, offering greater liquidity and improving tax reporting (1099 vs. K-1s)3. Of course, there are trade-offs to consider in seeking greater liquidity.

What’s next?

Private equity is now more accessible to individuals than ever before. Structural innovations have addressed accreditation, minimums, liquidity and tax reporting (1099 vs. K-1s). Private equity funds will likely have a larger role in target-date funds and 401(K) plans in the future.

Advisors need to take the lead in educating investors about the merits of private equity. They should address the questions raised here and determine the appropriate allocation to private equity. Advisors should help investors in evaluating the structural trade-offs of feeder funds, interval funds and auction funds.

This blog provides a high level overview regarding the opportunities presented by private equity. For additional information, please read the referenced articles, and related blogs on my site, or visit the iCapital Network site https://www.icapitalnetwork.com/insights/education/private-equity-essentials/

Sources:

1 Davidow, Anthony, “Private Equity: Innovation and Evolution”, Investments & Wealth Monitor, November / December 2019

2 Veronis, Nick “Private Equity Offers Resilience in a Downturn”, Investments & Wealth Monitor, August / September 2020

3 Employee Benefits Security Administration “U.S. DEPARTMENT OF LABOR ISSUES INFORMATION LETTER ON PRIVATE EQUITY INVESTMENTS”, JUNE 3, 2020